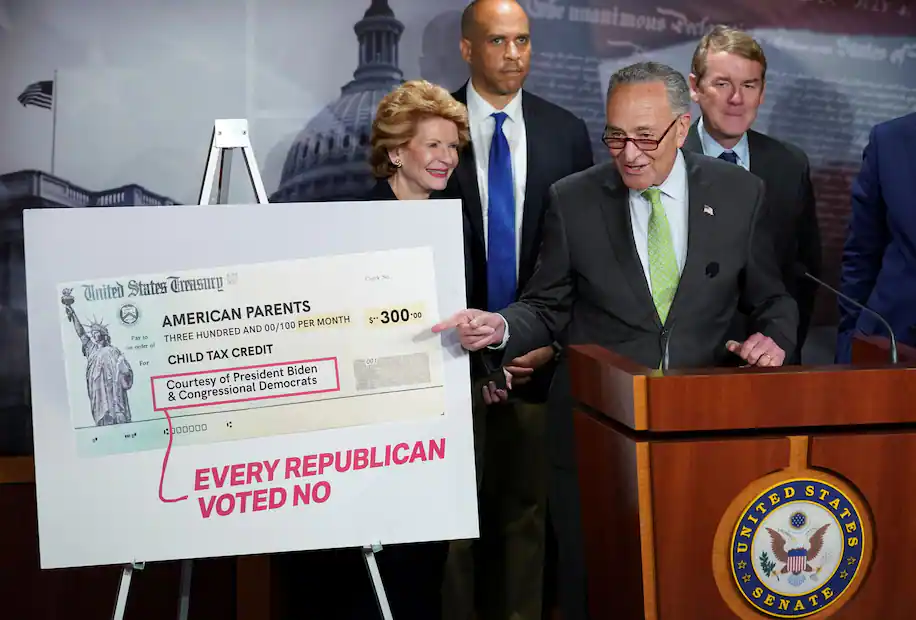

Senate Majority Leader Charles E. Schumer (D) speaks during a news conference on the expanded Child Tax Credit payments at the Capitol in Washington, D.C., on July 15. (Kevin Lamarque/Reuters)

By

Michelle Singletary

July 16, 2021|Updated today at 12:43 p.m. EDT

Over the next six months, the IRS will be sending billions of dollars to families with children ages 17 and younger. But the distribution is already causing anxiety.

Calculate how much you will get from the expanded child tax credit

The IRS and Treasury said the tax service deposited roughly $15 billion in bank accounts this week for the nearly 60 million children eligible for the monthly expanded child tax credit. Eligible families receive an advance payment of up to $300 per month for each child age 5 and under and up to $250 for each child ages 6 through 17.

Monthly child tax credit payments start hitting bank accounts this week. Here’s what you need to know if you’re eligible.

But many families are unsure whether their child qualifies for the credit, particularly those with newborns or custody issues, judging from questions posed during an online discussion ahead of the first distribution on July 15.

Ken Corbin, the IRS’s wage and investment commissioner and its chief taxpayer experience officer, joined me on the chat to take reader questions. And there were hundreds of people seeking clarification of eligibility.

Here’s a recap of the most frequently asked questions and responses to queries we weren’t able to get to during the discussion, edited for length and clarity. A few questions were also answered by IRS spokesman Eric Smith.

I have a child born in June, does she qualify to receive the advance child tax credit?

Corbin: For the tax year 2021, a qualifying child is an individual who does not turn 18 before Jan. 1, 2022, and who satisfies the following conditions:

— The individual is the taxpayer’s son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half brother, half sister or a descendant of any of them (for example, a grandchild, niece or nephew).

— The individual does not provide more than one-half of his or her own support during 2021.

— The individual lives with the taxpayer for more than one-half of the tax year 2021. The individual is properly claimed as the taxpayer’s dependent.

— The individual is a U.S. citizen, U.S. national, or U.S. resident alien.

Are you having problems with the IRS? Share your story with The Washington Post.

If the parents of minor children are separated, but not divorced, and filed joint returns in 2019 and 2020, do they equally divide the child tax credit?

Corbin: If the child tax credit was claimed by both parents, the advance payment will go to the bank account (usually a joint account) on the tax year 2020 return, or a check will be mailed to the address of record on the tax return. Advance Child Tax Credit payments are based on the children claimed on the taxpayer’s 2020 tax return (or 2019 if 2020 hasn’t been filed yet).

Later this year, the Child Tax Credit Update Portal (CTC UP) at irs.gov will be updated to allow taxpayers to inform us about the qualifying children they will claim on their 2021 tax return so that we can adjust the estimated child tax credit.

As part of the next covid relief bill, President Biden proposed an expanded child tax credit that would send direct payments to help struggling families. (Joy Yi/The Washington Post)

If my wife is due in August, will we still qualify for the program?

Singletary: The IRS says children born this year are eligible for the advance payments. Once the child receives a Social Security number, you can give that information to the IRS. But you’ll have to wait until the portal feature for such updates is active.

If the child is eligible, the IRS will go back and recalculate what you are due and spread the funds over the remaining months for the advance payments.

If, for whatever reason, the payments don’t start before the end of the year, you will have to claim the expanded child tax credit payments when you file your 2021 return next year.

IRS begins sending monthly checks to millions of American parents in crucial test for Biden

What if I claimed my child for 2020 because she was living with me but went to live with my ex this year?

Corbin: They should take one of the following actions:

— Agree to allow the other parent to claim that child for the child tax credit for 2021. They must receive from the child’s other parent a signed IRS Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent, and attach it to their 2021 tax return, on which they claim the Child Tax Credit.

— Consider using the update portal to unenroll from receiving advance child tax credit payments or to remove that child’s information that was provided to the IRS.

As a result, their future advance Child Tax Credit payment amounts will be reduced to take into account the removal of that child.

If they take neither action, they may need to repay the IRS the amount of advance child tax credit payments received for that child when they file their 2021 tax return next year.

One child, two stimulus payments: The weird way divorced families are double-dipping without even trying

My son turns 18 in December. Will I get child credit for the months he is 17?

Corbin: For the tax year 2021, a qualifying child is an individual who does not turn 18 before Jan. 1, 2022.

One of the conditions of the credit is that the child must live with the taxpayer for half of the tax year. What about a child born late in the year? Does he qualify?

Smith: A child born anytime during the year counts, even on the last day.

I am divorced and share custody of my daughter with my ex. We alternate claiming our child, and I claimed her in 2020. Should I opt out of the monthly tax credit?

Singletary: If you will not be claiming the child for 2021, you should unenroll from receiving the monthly payments. Otherwise, you may have to pay that money back next year. You have until Aug. 2 to stop the payments. The next unenroll deadline is Aug. 2.

I am not a U.S. citizen, but my three children are. I am a legal resident of the U.S. and pay taxes. Am I eligible for the tax credit?

Smith: Generally, yes. As a legal resident, you typically have a Social Security number. Resident aliens for tax purposes are the same as citizens.

Biden delivers remarks on Child Tax Credit relief payments

My sister and her kids live in Canada but are U.S. citizens. Do they qualify for the advance payments?

Corbin: No, you must have your main home in one of the 50 states or the District of Columbia for more than half the year.

Singletary: Your sister may still be able to claim the credit on her 2021 return, however. By the way, residents of Puerto Rico will not receive the advance payments being distributed from July to December, but they may be eligible for the temporary increase in the credit, which for 2021 is $3,000 for children 6 through 17 and $3,600 for children ages 5 and under.

The IRS also says residents of American Samoa, the Commonwealth of the Northern Mariana Islands, Guam or the U.S. Virgin Islands may be eligible for advance child tax credit payments but have to check with their local territory tax agency.

Opinion: Why conservatives shouldn’t worry about child tax credits

Can a grandmother who is head of household supporting a grandchild claim the credit?

Singletary: If the grandmother can claim the children, she is entitled to the credit, assuming she qualifies based on income.